See This Report about Independent Financial Advisor Canada

See This Report about Independent Financial Advisor Canada

Blog Article

Top Guidelines Of Investment Representative

Table of ContentsThe 8-Second Trick For Independent Financial Advisor CanadaThe Buzz on Retirement Planning CanadaGetting My Tax Planning Canada To WorkExcitement About Investment RepresentativeWhat Does Financial Advisor Victoria Bc Do?Our Independent Financial Advisor Canada Statements

“If you had been to purchase a product or service, state a tv or some type of computer, you might want to know the specifications of itwhat are its components and what it can create,” Purda details. “You can think about buying monetary guidance and help just as. Folks need to find out what they are getting.” With monetary guidance, it’s important to remember that this product is not bonds, shares or any other assets.It’s things like cost management, planning pension or paying off personal debt. And like buying a pc from a reliable organization, customers want to know they are purchasing monetary guidance from a reliable expert. Certainly one of Purda and Ashworth’s best findings is approximately the costs that financial coordinators demand their clients.

This conducted genuine irrespective of the fee structurehourly, percentage, assets under control or flat fee (inside research, the buck property value charges ended up being the exact same in each case). “It nonetheless comes down to the worthiness idea and anxiety on the customers’ part they don’t understand what they truly are getting in change for those fees,” claims Purda.

Ia Wealth Management Can Be Fun For Everyone

Hear this informative article as soon as you listen to the definition of financial expert, just what pops into the mind? Many consider an expert who is able to give them economic advice, especially when it comes to trading. That’s a great place to begin, however it doesn’t decorate the entire image. Not really near! Monetary analysts can people with a lot of additional money objectives too.

A monetary specialist assists you to develop wide range and shield it for continuous. They can calculate your own future financial requirements and program how to extend your your retirement cost savings. Capable additionally help you on when to begin making use of Social protection and utilizing the cash in your your retirement reports in order to prevent any horrible charges.

The Best Guide To Private Wealth Management Canada

They can assist you to find out exactly what mutual funds are right for you and explain get more to you how exactly to control making more of your own financial investments. They can also support see the dangers and exactly what you’ll have to do to attain your aims. A practiced financial investment expert will help you stay on the roller coaster of investingeven as soon as assets simply take a dive.

Capable provide you with the advice you ought to develop an agenda to help you make sure that your wishes are executed. And you can’t place an amount label regarding the comfort that accompany that. Based on a recent study, the common 65-year-old few in 2022 needs around $315,000 conserved to cover healthcare prices in retirement.

The Definitive Guide for Tax Planning Canada

Now that we’ve gone over what economic advisors do, let’s dig to the different types. Here’s a beneficial rule of thumb: All economic planners are economic advisors, yet not all experts tend to be planners - https://www.cybo.com/CA-biz/lighthouse-wealth-management_50. An economic coordinator targets helping men and women generate intentions to achieve long-lasting goalsthings like beginning a college investment or saving for a down payment on property

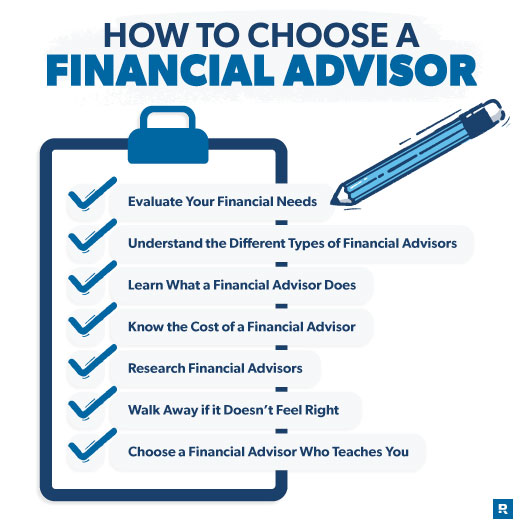

Exactly how do you understand which financial specialist suits you - http://www.video-bookmark.com/bookmark/6100844/lighthouse-wealth-management,-a-division-of-ia-private-wealth/? Listed below are some steps you can take to make certain you’re employing just the right individual. What now ? when you yourself have two terrible choices to pick? Effortless! Discover more choices. The more choices you may have, a lot more likely you're to manufacture a great decision

Everything about Lighthouse Wealth Management

All of our Smart, Vestor plan causes it to be easy for you by showing you to five monetary analysts who are able to last. The best part is, it is completely free to have connected with an advisor! And don’t forget to come calmly to the interview prepared with a list of questions to inquire about so you're able to decide if they’re a great fit.

But pay attention, because a consultant is actually wiser as compared to ordinary bear does not give them the authority to reveal what you should do. Sometimes, advisors are loaded with on their own since they have significantly more degrees than a thermometer. If an advisor starts talking down to you personally, it's time and energy to demonstrate to them the doorway.

Understand that! It’s essential that you and your economic advisor (whoever it ultimately ends up getting) take the same web page. You want a specialist having a lasting investing strategysomeone who’ll promote one to keep investing constantly if the marketplace is up or down. tax planning canada. You also don’t wish utilize a person that forces one to invest in a thing that’s as well risky or you are uncomfortable with

Unknown Facts About Independent Financial Advisor Canada

That combine gives you the variation you'll want to effectively invest when it comes down to longterm. While you research monetary analysts, you’ll probably come across the term fiduciary duty. All this suggests is actually any expert you hire must act in a way that benefits their client and not their own self-interest.

Report this page